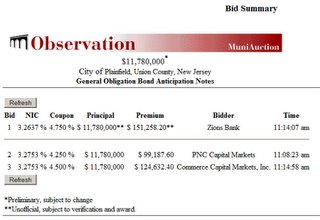

Plainfield's first online auction of anticipatory notes took place yesterday morning between 11:00 and 11:15.

Plainfield's first online auction of anticipatory notes took place yesterday morning between 11:00 and 11:15."I believe this method of getting a community's obligations marketed is going to revolutionize the municipal finance market," said Plainfield Mayor Al McWilliams, "since it simplifies the process so much for both the municipality and for the buyers in the marketplace."

The Grant Street Group, which manages online auctions through its "MuniAuction" website handled the marketing of Plainfield's offering. Their efforts included advertising in the financial press and advising potential customers through their email alerts.

City Administrator Norton Bonaparte and Finance and Administration Director Ron West eagerly logged on just before the 11:00 am start time. Once signed on, they waited several minutes for the first bid to appear. Suddenly, the screen refreshed and the details of the first offer--by PNC Capital Markets--were displayed. Within a few more minutes, two other bids were posted, each time the screen refreshing and rearranging the bids in the order most advantageous to the City. Promptly at the 11:15 am cutoff time, the screen froze, the auction was marked closed and a tentative winner was identified: Zions Bank, with the lowest NIC [net interest charge] of 3.2637%.

The sale is subject to completion of the necessary paperwork by the bidder and the City. The transaction is expected to close November 10th, at which time the proceeds will be wired to the City's account.

Zions Bank, originally founded to serve members of the Church of Jesus Christ of Latter-Day Saints, or Mormons, is a publicly traded bank corporation in Utah. A brief history can be found here.

Keywords: Plainfield, government, finance, technology

No comments:

Post a Comment